Imagine driving home from work when suddenly another vehicle runs a red light and crashes into your car. The accident leaves you with severe injuries requiring extensive medical treatment and months of rehabilitation. Then comes the devastating news: the at-fault driver either has no insurance or carries only minimum coverage. This scenario, unfortunately, plays out countless times across our nation, leaving victims to face enormous medical bills and financial hardship. That’s why understanding and securing large uninsured/underinsured motorist (UM/UIM) coverage is crucial for protecting yourself and your family.

Uninsured Drivers Pose a Significant Risk On American Roads

In 2022, the Insurance Research Council reported that 14% of drivers were uninsured. With AAA’s estimate of 255 million drivers, 35.7 million are uninsured. This alarming statistic shows the need for full auto insurance. It questions road safety and drivers’ financial responsibility.

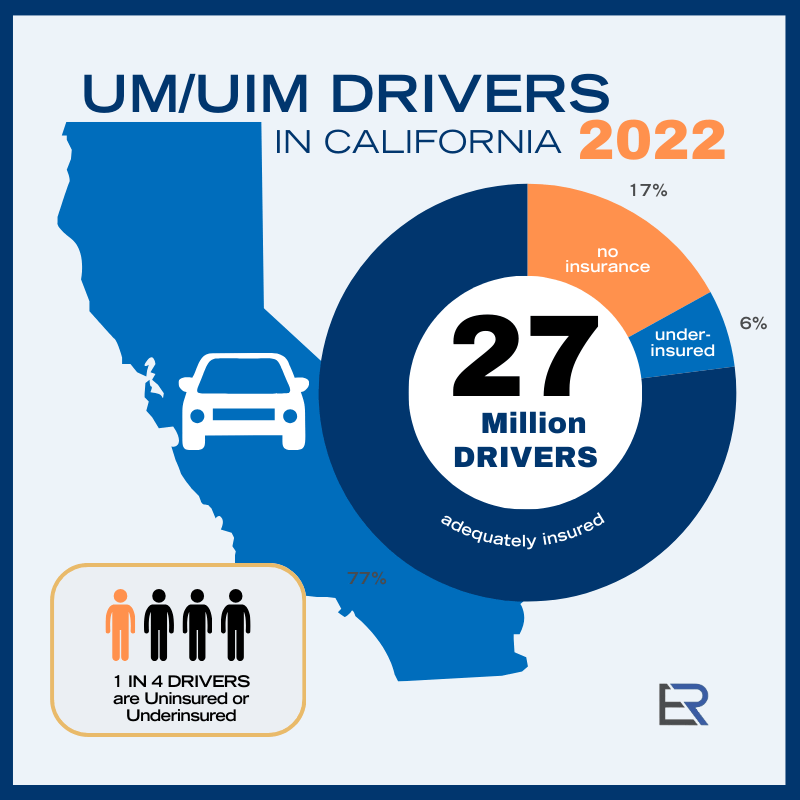

California Uninsured/Underinsured Statistics

According to the Insurance Information Institute, approximately 17% of drivers in California were uninsured, which is about 4.59 million drivers out of the state’s 27 million drivers.

Furthermore, according to a report by the Insurance Research Council, 6% of drivers in California are underinsured.

This means that nearly one out of every four drivers in California in 2022 either had no liability insurance or carried insufficient coverage to fully protect accident victims.

Auto Insurance Rate Hikes in 2025 in California

In 2025, California drivers should expect significant auto insurance rate increases, making large Uninsured/Underinsured Motorist (UM/UIM) coverage more critical than ever. As premiums rise, experts predict an increase in uninsured drivers on California’s roads, leaving responsible drivers at greater financial risk.

Effective January 1, 2025, Senate Bill 1107 raises the state’s minimum auto insurance liability limits from $15,000 per person/$30,000 per accident for bodily injury and $5,000 for property damage to $30,000/$60,000/$15,000. This legislative change aims to provide better financial protection but is expected to result in higher premiums for many drivers, especially those currently carrying minimum coverage.

Other factors include:

- Rising repair and medical costs

- Inflation and economic factors

To mitigate the impact of these rate increases, California drivers are advised to review their current policies, compare quotes from multiple insurers, and explore available discounts. Maintaining a clean driving record and considering higher deductibles can also help in managing premium costs.

| Category | 2024 Liability Limits | 2025 Liability Limits |

|---|---|---|

| Bodily Injury | $15,000 | $30,000 per person |

| Bodily Injury (per accident) | $30,000 | $60,000 per accident |

| Property Damage | $5,000 | $15,000 per accident |

Understanding the Coverage Gap

The reality of modern road safety extends beyond defensive driving and maintaining your vehicle. In many states, a significant percentage of drivers operate vehicles with either no insurance or bare minimum coverage. Currently, state minimum requirements often range from $15,000 to $25,000 per person for bodily injury liability. However, these amounts become woefully inadequate when confronting the actual costs of serious injuries.

Consider this: a single day in the intensive care unit can cost upwards of $10,000. Add surgical procedures, rehabilitation, medical equipment, and ongoing care, and medical expenses can quickly surpass $100,000. This doesn’t even account for lost wages, pain and suffering, or long-term disability costs. The gap between minimum coverage and actual damages can be financially devastating for families.

Why Standard Coverage May Not Be Enough

Many drivers believe their standard auto insurance or health insurance provides sufficient protection. However, this misconception can lead to severe financial consequences. A catastrophic injury involving spinal cord damage or traumatic brain injury can result in medical bills exceeding $1 million in the first year alone. Long-term care costs, home modifications, and ongoing therapy can add hundreds of thousands more.

Furthermore, the impact extends beyond immediate medical expenses. Lost earning potential due to permanent disability, the need for specialized equipment or vehicles, and the cost of in-home care can create financial burdens lasting decades. Without adequate UM/UIM coverage, families often face difficult choices between necessary medical care and financial stability.

Benefits of Large UM/UIM Policies

Investing in substantial UM/UIM coverage offers multiple layers of protection. First, it safeguards you against hit-and-run drivers, where identifying the at-fault party could prove impossible. Second, it provides crucial coverage when accidents involve multiple injured parties, where the at-fault driver’s policy limits must be split among several claims.

The coverage also extends to situations beyond traditional car accidents. It can protect you as a pedestrian, cyclist, or passenger in someone else’s vehicle. Perhaps most importantly, the cost of increased UM/UIM coverage is relatively modest compared to the potential benefits it provides. Often, doubling or even tripling your coverage amounts results in surprisingly affordable premium increases.

Recommended Reading: What To Do When the Other Driver’s Insurance Isn’t Enough For My Injuries

Common Misconceptions Debunked

Let’s address several misconceptions about UM/UIM coverage:

“My health insurance will cover everything”: While health insurance covers medical treatment, it won’t compensate for lost wages, pain and suffering, or long-term disability. Additionally, health insurers may place liens on your settlement, reducing your overall recovery.

“I have good liability coverage, so I’m protected”: Liability coverage protects others from your actions but does nothing to protect you from underinsured drivers. Your liability limits have no bearing on your recovery when someone else causes an accident.

“UM/UIM coverage is too expensive”: When compared to the potential financial devastation of a serious accident with an underinsured driver, the cost of adequate UM/UIM coverage is remarkably reasonable. Many drivers can significantly increase their coverage for just a few dollars more per month.

Making Informed Coverage Decisions

When selecting UM/UIM coverage limits, consider these factors:

- Your current income and future earning potential

- Family obligations and dependents

- Assets that need protection

- Local statistics on uninsured drivers

- Cost of medical care in your region

We recommend carrying UM/UIM limits equal to your liability coverage. If you carry $300,000 in liability coverage, you should have the same amount in UM/UIM protection. This ensures consistent protection regardless of who causes an accident.

A Common UM/UIM Example

Suppose a driver, John, is involved in a severe accident caused by an underinsured driver. The at-fault driver carried only $25,000 in coverage, while John’s medical bills exceeded $200,000.

Fortunately for John, he purchased a $500,000 UM/UIM policy. This foresight enables him to receive appropriate medical care and fair compensation for their injuries, lost wages, and pain and suffering.

Without this coverage, he would have faced overwhelming medical debt and potentially bankruptcy, despite being the innocent victim in the accident.

But does John’s large UM/UIM policy guarantee full compensation for his losses without legal assistance?

Unfortunately, even with adequate coverage, insurance companies often aim to minimize payouts. They may dispute the extent of injuries, the necessity of medical treatments, or the calculation of lost wages and pain and suffering. Without skilled negotiation or legal representation, John could risk receiving less than what he is entitled to under his policy.

How Can a Personal Injury Attorney Assist in a UM/UIM Claim?

A seasoned attorney can help you navigate the claims process, gather evidence to support your case, and ensure that the insurance company honors the full value of your auto insurance policy. Additionally, an attorney can handle any disputes, saving you time and stress while maximizing compensation. With legal assistance, you have a better chance of recovering all damages you’re entitled to, rather than settling for less than his policy allows.

Taking Action

Protecting yourself and your family requires proactive steps:

- Review your current policy limits immediately

- Consult with insurance professionals about increasing your UM/UIM coverage

- Understand your policy’s stacking options and how they affect your total coverage

- Schedule regular policy reviews to ensure your coverage grows with your needs

Recommended Reading: Do I Have An Uninsured/Underinsured Motorist Claim?

Get Help with Your UM/UIM Claim Today

If you’ve been injured in a serious accident, don’t face your insurance claims alone. Contact El Dabe Ritter Trial Lawyers for a free consultation to review your coverage and explore your options. Our team understands how critical UM/UIM policies are in protecting accident victims and their families, and we’re here to fight for the compensation you deserve. Take the first step—reach out to us today and let us help you secure your future.

Fill out our form today to schedule your free consultation and take the first step towards justice.