When it comes to auto accidents, any extra coverage or assistance can go a long way. Medical payments coverage, or more commonly known as MedPay, is an elective insurance option that nearly all auto insurance companies offer.

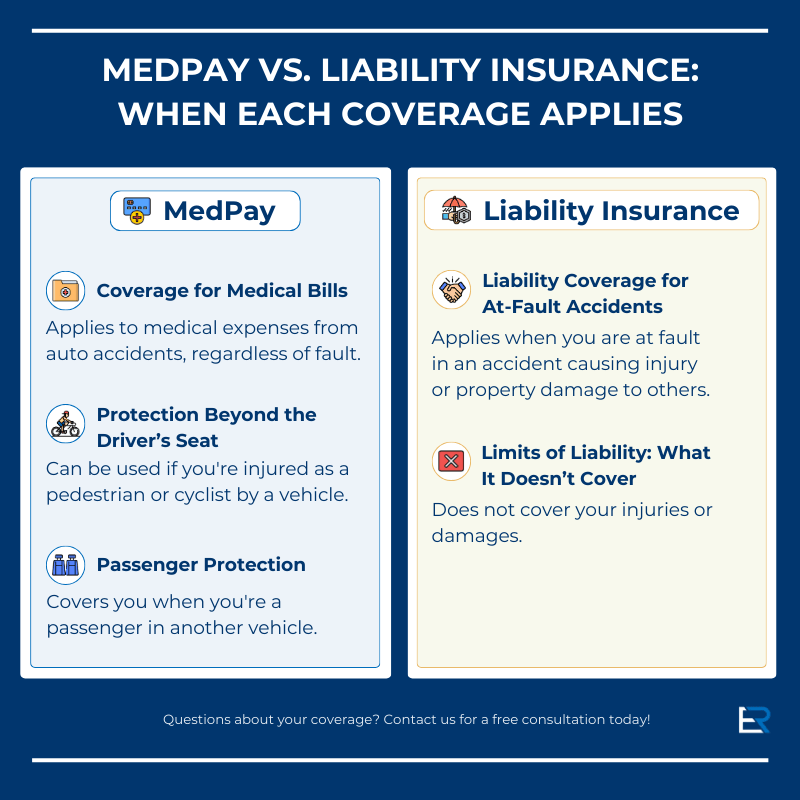

Medical payments coverage pays for medical expenses for you, your passengers, bicycle riders and pedestrians if they are injured in an accident involving your vehicle.

It can also provide coverage in other situations such as:

- You’re a passenger in another vehicle

- You’re injured by a vehicle as a pedestrian

- You’re riding your bike and get injured by a vehicle

- You’re hurt while taking public transportation

Medical payments coverage does not cover:

- Car repair bills

- Expenses unrelated to the accident

- Property damage costs

- Accidents not involving a car

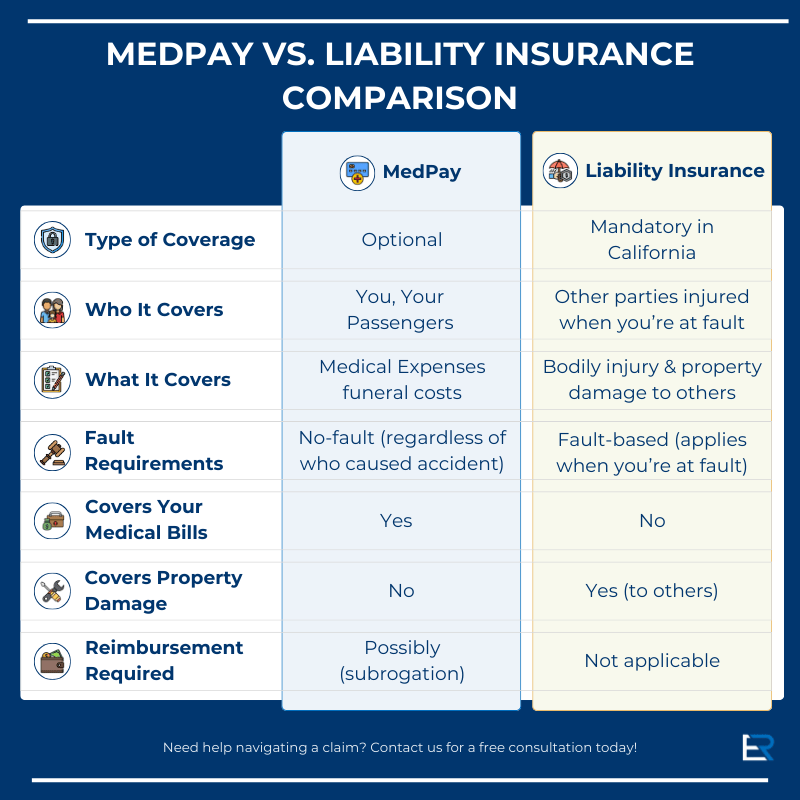

MedPay is optional in most states, including California. It’s also supplemental to regular health insurance, so it’s important to check your health insurance policy to see who the primary payer is for certain medical expenses.

For those without health insurance, MedPay can act as a safety net, reducing the risk of potentially crippling medical bills. You must have auto liability coverage to purchase MedPay, and you must be injured in an auto-related accident to utilize it.

Even if you do have excellent health insurance, MedPay coverage can be a great investment for drivers worried about managing car accident-related medical expenses — both for themselves and their passengers.

What Expenses Does MedPay Cover?

It can cover various expenses, including:

- Doctor and hospital visits

- Ambulance and EMT fees

- Health insurance deductibles and co-pays

- Surgery, X-rays and dental procedures

- Funeral expenses

How Does MedPay Work?

MedPay will typically provide payments to a medical provider or to the car accident injury victim. It usually kicks in quickly to cover medical payments, health insurance deductibles, copays and expenses not fully reimbursed by your primary medical insurance.

The policy limits on MedPay coverage are per person, meaning each injured individual can claim up to the specified limit under the policy. However, the insurance company won’t pay the same bills under both your medical payments coverage and liability coverage.

How Much Does MedPay Cost?

Costs depend on various factors, including your location, chosen coverage limits and driving history.

Still, MedPay coverage is relatively inexpensive, costing around $20 to $50 per year for typical coverage limits ranging from $1,000 to $10,000. Plus, there are no deductibles or copays. Higher limits are available at additional costs.

In a personal injury claim, MedPay gives injury victims more flexibility in choosing which providers to see and how the bills are paid.

It’s a good idea to carry coverage equal to your health insurance deductible, so you can use MedPay to cover your out-of-pocket medical expenses. If you don’t have health insurance, you may want a higher MedPay limit to help pay for any auto accident-related medical bills.

How to Use MedPay

Report the Incident to Your Insurance

You or your attorney must first inform your auto insurance company that you were involved in a car accident and suffered bodily injuries.

A MedPay claim will then be opened for you, where you’ll be able to submit your medical bills for reimbursement.

The insurance adjuster handling your MedPay claim might also be the same person handling other claims from the accident, like collision coverage, uninsured motorist claims, or property damage.

Documents Needed to Verify Your Injury

Your auto insurance company may require verification that you were injured in a motor vehicle accident and may ask for one or more of the following:

- Police traffic collision report

- Written or recorded statement from you

- Copies of medical records and/or a brief report from your doctor

Following verification, your provider can submit itemized charges for medical treatments directly to the insurance company, which will prompt them to issue payment to either you or your doctor.

What Happens If I Have Multiple Accidents?

MedPay coverage payments are accessible for a specific vehicle accident up to the coverage limits. If you sustain injuries in separate incidents, the majority of MedPay policies offer the coverage limit for each event — $2,000 for medical care associated with the first accident, an additional $2,000 for medical care linked to the second accident, and so on.

Common Insurance Company Delay Tactics

Some auto insurance companies may try to limit or delay MedPay payments using several tactics:

- They may do a “billing review,” where the provider’s bills are compared with “typical” charges for the services rendered. These “typical” charges may or may not be actual charge rates in your area.

- They may require additional paperwork from your medical provider, such as detailed itemized charges.

An experienced personal injury attorney can assist in getting any bills reimbursed promptly.

How MedPay Coverage Can Affect Your Claim

Using MedPay will not affect your ability to pursue a bodily injury liability claim against the at-fault driver. You will still be able to seek compensation for lost wages, medical expenses, pain and suffering, and other damages through the other driver’s liability insurance. This can be especially valuable if settlement negotiations are dragging out or the other driver is disputing liability.

Since MedPay doesn’t require determining fault, you can receive quick payment for medical bills. That can help ease financial stress while you are waiting for a settlement from other driver’s insurance.

Keep in mind that MedPay insurers often pursue reimbursement through a process called subrogation. This means they may require repayment from any settlement you receive from the at-fault party for your medical bills and injuries. As a result, a portion of your settlement may go toward reimbursing your MedPay insurer. Understanding this process can help you plan for potential reductions in your net recovery.

When there is a separate bodily injury liability claim against the at-fault driver, your insurance company will require you to pay them back out of any eventual settlement you may receive from the responsible driver or their insurance company. However, specific legal rules exist that dictate when and how much of these funds are required to be paid back.

What About Personal Injury Protection (PIP) Coverage?

Personal injury protection (PIP) is mandatory in no-fault states and typically offers more coverage than MedPay. Similar to MedPay, PIP pays for medical expenses after an auto accident, but PIP coverage is generally further reaching. It covers things like lost wages, up to the limit of the policy, without considering who was at fault for the accident.

If you’re purchasing auto insurance, you should consider whether you need MedPay and if you are required to have PIP coverage. Having both can have its advantages in certain situations.

For example, if you hit your PIP limit on medical bills, you would need to pay the rest of the amount out of pocket. MedPay may be able to cover that amount.

Keep in mind, however, that some states do not allow you to have both types of coverage at the same time. California does not require PIP coverage, but insurers may offer similar add-on options that provide coverage beyond standard liability or MedPay.

Have Questions About Your Personal Injury Case?

At El Dabe Ritter Trial Lawyers, we understand the intricacies of MedPay coverage and are ready to guide you through each step of the personal injury claim process. Our experienced team is committed to ensuring you receive the maximum compensation allowed.

Don’t navigate the complexities of MedPay alone. Contact El Dabe Ritter Trial Lawyers today for a free consultation. Let our experienced team secure the compensation and peace of mind you deserve.

Fill out our form today to schedule your free consultation and take the first step towards justice.

Learn more about how our personal injury lawyers can help you in: