When your car is a total loss and you’re still making payments, the financial pressure builds up fast. Injured drivers often face loans they can’t afford while trying to recover. If you’re wondering what happens to your loan if your car is totaled, your insurance coverage, loan balance, and legal options will determine the outcome.

When Is a Car Considered a Total Loss?

After a serious crash, insurers don’t always approve repairs for every damaged vehicle. In some cases, the damage is so extensive that fixing the car isn’t practical—or even safe. That’s when insurance companies may declare the car a total loss.

Insurers may declare a vehicle a total loss if:

- The damage makes it unsafe to repair the car.

- The repair costs exceed the value of the car itself, or

- State regulations require insurers to declare the car a total loss when the damage meets a certain threshold.

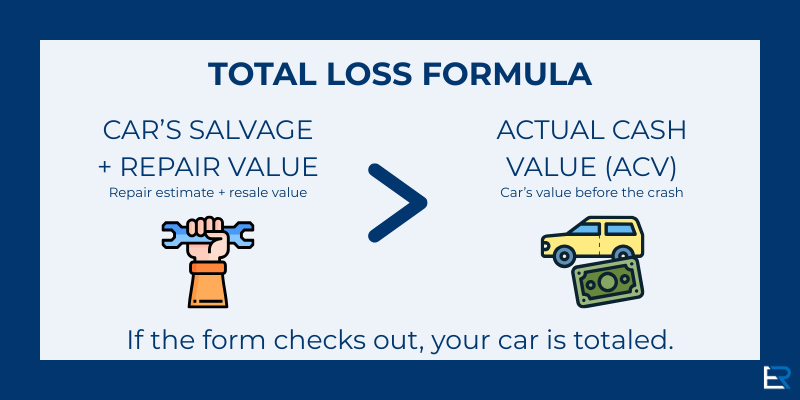

Insurance companies use specific formulas to make this determination. In California, most insurers follow the Total Loss Formula (TLF): if the cost of repairs plus the car’s salvage value equals or exceeds its actual cash value (ACV), the car is considered a total loss. The ACV is the market value of your car right before the accident, not what you originally paid.

Some insurance companies use a percentage-based threshold, like 70% or 80% of the car’s value, while others rely strictly on California’s TLF, which also factors in the vehicle’s salvage value.

What to Expect from Insurance After a Total Loss Accident

After a serious crash, one of the first things people want to know is whether their insurance will cover the full cost of the damage. If you’re still paying off a loan, your financial recovery after a total loss depends largely on the insurance coverage you carry.

Most drivers rely on comprehensive or collision coverage to handle a total loss claim. These policies typically pay out your car’s actual cash value (ACV), which is what your vehicle was worth right before the accident, not what you paid for it, and not necessarily what you still owe on your loan.

The insurance company sends this payment directly to your lender to cover the remaining balance. If the payout doesn’t cover the complete loan amount, you’re still responsible for the difference—unless you have GAP insurance to cover that shortfall.

To ensure you’re receiving a fair offer, it’s a good idea to research your car’s value. Use tools like CCC One or a Mitchell report to estimate a vehicle’s value based on comparable local dealership sales in the area where it’s garaged. This can help you spot a low offer and push back if the insurer undervalues your claim.

Recommended Reading:

What Happens to Your Loan If Your Car Is Totaled?

Many drivers mistakenly assume they won’t have to pay their loan if their car is totaled. What happens to your loan if your car is totaled depends on how much you still owe and whether your insurance or GAP coverage pays the difference.

This can leave you in a tough financial spot, especially if the insurance payout falls short of your remaining loan balance. You will still be legally responsible for paying the full loan amount. Falling behind on payments could damage your credit or result in collections, adding even more stress after a serious accident.

How GAP Coverage Can Help Protect You

GAP stands for Guaranteed Asset Protection. GAP coverage protects you when your loan balance exceeds your car’s value. It pays the difference between your car’s actual cash value and your loan balance.

Example:

- Your car’s value is $15,000.

- Your loan balance is $21,000.

- GAP coverage covers the $6,000 shortfall that would otherwise come out of pocket.

GAP coverage is also helpful when you total a financed car because the car’s value can drop quickly, while your loan balance may stay high. Many lenders or lease agreements offer this protection when you buy or lease a vehicle.

Can You Keep a Totaled Car?

Under certain circumstances, you can keep your totaled car instead of letting the insurance company take it. This option is called “retention” and may appeal to drivers who want to repair their car, use it for parts, or keep it for sentimental reasons. Before deciding to keep a totaled vehicle, there are critical financial and legal factors to consider.

If you decide to keep the vehicle, the insurance company will still pay you the car’s actual cash value, but they’ll subtract the salvage value—the estimated amount the vehicle could sell for at a salvage yard. You’ll also likely be responsible for towing, storage, and future repair costs out of pocket.

In most cases, the vehicle will be assigned a branded title, such as “salvage” or “rebuilt” which can affect its future use and value. This can make it harder to get full insurance coverage and lower the resale value.

What a Total Loss Accident Could Mean for Your Injury Compensation

When another driver causes a crash, the damage goes beyond your car—it affects your health, income, and everyday life. If your vehicle was a total loss and you were injured, you may be entitled to compensation through the at-fault driver’s liability insurance. This can include far more than just the cost to repair or replace your car.

Through a personal injury claim, you could recover:

- Medical bills

- Lost income

- Pain and suffering

- Transportation costs (like a rental car)

- Money to help buy a new car or cover a down payment

Getting compensation is possible, but the process can be complicated. Handling insurance claims, paperwork, and proving fault can be overwhelming—having experienced legal support makes a big difference.

How Our Car Accident Attorneys Can Help After a Total Loss Crash

If you were injured in a car accident and your vehicle was a total loss, you’re likely facing more than just car trouble. You may be dealing with medical bills, missed work, stress from the insurance company, and pressure to keep paying your car loan. It can feel overwhelming, especially when you didn’t cause the accident.

At El Dabe Ritter Trial Lawyers, we help injury victims through every step of the process. We can help you by:

- Filing a personal injury claim to recover money for medical care, lost income, and pain and suffering.

- Handling the insurance company so you don’t have to worry about lowball offers or complex paperwork.

- Negotiating to recover full compensation—not just for your injuries, but also for your property damage and rental car costs, and help to buy a new car if needed.

You don’t have to figure this out alone. We offer free consultations, and you don’t pay us unless we win your case.

Injured in a Total Loss Accident? Let Us Handle the Rest

A totaled car and a serious injury can turn your life upside down, but you don’t have to face it alone. With over 20 years of experience, El Dabe Ritter Trial Lawyers has recovered millions of dollars for injured car accident victims across California. We’ll fight to help you recover medical costs, lost wages, and the full value of your vehicle, while you focus on healing.

Call now or fill out our contact form to speak with a car accident attorney. Your consultation is free, and you pay nothing unless we win your case.

Disclaimer: The information provided in this blog post is not intended as legal advice and should not be relied upon as such. You should consult with an experienced attorney for advice on your specific situation.